The industry has gone through another tough quarter, and when looking ahead, improvement is very difficult to predict. New trading barriers are being considered against China. Demand is disappearing from Europe. The so-called “consolidation” is not creating operational room for leading companies. While overcapacity is no longer an immediate thread due to shutdowns and low utilization, the inventory oversupply continues to weigh on ASPs. While solar energy is becoming more viable, the companies making solar products are becoming less so each quarter. Certainly, the cycle of correction is bound to clear current conditions, but new worries instead of answers are being added to the list of concerns. Just recently, the notion evolved around manufacturing cost and the ability stay strong enough financially to remain competitive for enough time to outlive the competition. The add-on question now is if the Chinese, who succeeded in cost reductions, can survive another obstacle: national protectionism.

Q-Cells had been delisted after the acquisition by Hanwha Group, the Korean parent of Hanwha SolarOne Co Ltd (NASDAQ: HSOL). This is a rare example of the consolidation effort in the public company domain. Global consolidation has not produced enough space to open up opportunities. Companies lowered utilization to cope, which now translates to shutdowns and into layoffs. Those actions are necessary to reduce heavy module inventory produced in the first part of the year, which has held up cash resources. Logically, reduction of inventory, labor cost savings and reduced procurement is expected to put more cash flow into the balance sheets. While manufacturing costs continued to drop, polysilicon costs reached reasonable levels versus spot. Some companies, all Chinese, are on the solid path to reduce non-silicon costs to below $0.50 per watt and to $.12- to $.14 per watt for poly. Still, ASP continued to move relentlessly downward to $0.70 per watt, pressuring gross margins into low digits.

Also in Q2, foreign exchange had made a critical impact on income statement. Improved Yuan exchange against the Euro added losses to already stretched deficient income statements.

Policies have erected a wall of protectionism in the US, and it seems that similar convictions will take place in the EU. Nine Chinese companies out of 18 on the list (Q-Cells and Suntech not included) are being put to another test, which may break their global status. The alternative is China’s domestic demand, aimed by 2015 to reach 40GW as recently speculated. This would offer a lot of room for the future; however, Chinese market lacks infrastructure and state-governed initiatives had to support those targets with more facts. Moreover, most of SOE involved in energy generation are related to small solar enterprises, which accommodate parents’ needs. In return for projects, those continue to unload solar products regardless of costs. In doing so, they add to inventory glut. The optimism around China for the second half of 2012 has been shaken, and it will take more than just forecasts to stabilize expectations.

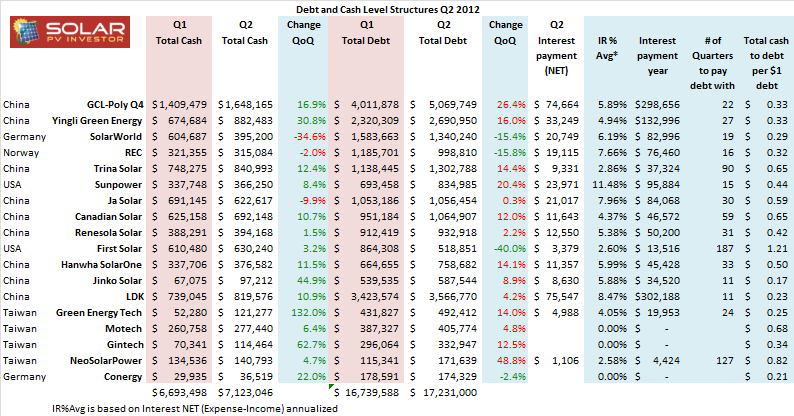

Cash and Debt Q2

If the choice were to continue with the global market, manufacturing presence in indigenous settings becomes a requirement. Cash – or lack of it –restricts this choice, so work in emerging markets offers promising balance. Despite the span of the EU investigation essentially placing the possibility of custom fees on all solar products, it is highly unlikely we will see the Chinese abandon Europe. The US levies have been mostly neutralized by the majority of the tier-1 companies, using Taiwanese cells or their own sources outside of China. Joint ventures and acquisitions are very possible for the top cash holders. Especially with depressed pricing for solar assets, finding an opportunity globally may not be that difficult.

Faced with all those factors, activities on balance sheets see more debt increases. Thankfully, the majority of the quarterly losses had limited cash-draining impacts. Nothing has really changed from the attempt to stay viable financially, with a focus on preserving cash.

While LDK Solar Co., Ltd (ADR)(NYSE: LDK) has remained on the watch list for the last six months, having the most destroyed balance sheet and highest interest payment, another heavy debt holder is Suntech Power Holdings Co., Ltd. (ADR)(NYSE: STP), which has not even made it to the evaluation stage. The company, allegedly affected by fraud worth $500M, has not released its financial results for Q2 due to assessing financial impact. In addition, another financially waning company, JinkoSolar Holding Co., Ltd. (NYSE: JKS), still remains in the risk zone, having limited access to cash. Another company looking weaker this quarter is SolarWorld AG (ETR: SWV). While it refinanced some of its loans and paid off $243M, in the process it reduced 34% of its cash, which is not instant reason to worry, but low cash-generation abilities across the industry can become a huge problem fairly quickly.

Starting our analysis with companies which paid the debt first, First Solar, Inc. (NASDAQ: FSLR) had reduced its debt by almost 40%, or $345M, after completing a number of solar plant sales. The second high payer was the previously mentioned German SolarWorld with $243M, and the third, Norwegian REC Group, with $186M. With the exception of Conergy, which paid down $4M of debt, everyone else brought in more borrowing. Companies that added the most debt were: GCL Poly with $1B (yes, billion), followed by Yingli Green Energy Hold. Co. Ltd. (ADR) (NYSE: YGE) with $370M, and Trina Solar Limited (ADR) (NYSE: TSL) with $164M. GCL has increased its borrowing over the period of the last six months. The largest % debt increase was Taiwanese Neo Solar Power, with 48%, from $115M to $171M.

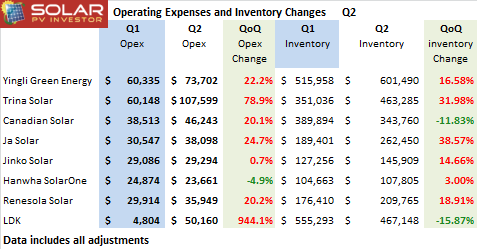

OPEX and Inventory Q2

Companies that added the most cash in Q2 were big debt takers: GCL Poly, Yingli, and Trina with $238M, $207M and $92M, respectively. However, the largest % increase was Green Energy Technology from Taiwan with 132%, from $52M to $121M.

Overall, debt increased by $2.3B for the total of 14 solar companies. The three leading cash-draining companies in the period were SolarWorld with $209M, JA Solar Holdings Co., Ltd. (ADR) (NASDAQ: JASO) with $68M and REC Group with $6M. SolarWorld used the money to pay its debt. JA was not so lucky; the company added around $3M to its debt; however, JA added the least to its debt out of all Chinese companies.

There were only two companies that managed to add cash and reduce debt: First Solar and Conergy Group. JA Solar is an example of the loss of cash and addition of the debt.

GCL Poly with $5B, LDK Solar with $3.5B and Yingli Green Energy with $2.7B were the three largest debt holders in the industry. Suntech, which was not assessed, held $2.2B in Q1. Revenues produced by the group were in the area of $5.5B in Q2 (excluding GCL Poly). GCL-Poly with $1.6B, Yingli with $882M and Trina with $660M held most of the cash. Those with the least amount of cash included Conergy with $36M, Jinko Solar with $97M and Gintech with $114M.

Regarding bonds payable within 12 months: JA Solar had $220M (paid down to $130M today), Jinko Solar had $114M and, Suntech, in March of 2012, had $511M (Q1 data). The largest amount of short-term borrowing was by LDK Solar with $2.4B.

Operational statistics for the Chinese companies in Q2 include level of inventory worth $3.1B. Considering that JA, ReneSola Ltd. (ADR) (NYSE: SOL) and LDK are component sellers, 60% of this inventory was ready for sale modules, while the rest are component and raw materials. This indicates 2.3GW of module inventory. Sales for Q2 were at 3GW of modules, which confirms that turnover days are equal to a full quarter on average for the peer group. If companies are running at 50% capacity and periodical shutdowns are made, inventory should see a significant drop, fueled by even deeper market adjustments due to lower ASP. The assessment period will double, in return making inventory adjustment deeper.

R&D spending in total for the Chinese enterprises was $48M, with Renesola spending $17M out of the total. The company had created new lines of wafers and modules: Virtus II. LDK, in the same period, delivered M3 wafer, at an R&D cost of $4M. Renesola is expanding its polysilicon capacity, while LDK is keeping its own shut, a paradox based on disparity of capital spent and operational costs set apart by technological progress and not-so-prudent spending by LDK Solar at the height of its glory.

Selling, general and administrative expenses were over $356M for all Chinese companies. LDK added $31M impairment on land assets and Trina wrote down $45M in doubtful accounts.

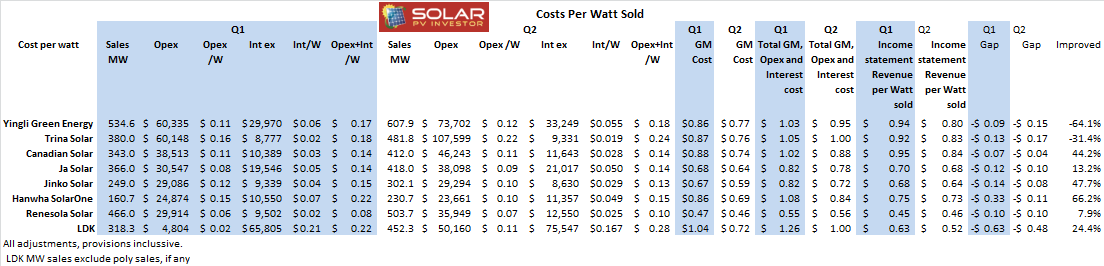

Costs per watt sold Q2

Lastly, a snapshot of ASP and manufacturing data: Suntech sold modules at $0.86 per watt as the high, and Jinko and JA at $0.74 as the low. For all-in costs, the best result was $0.66 for Trina and Jinko. The figure includes $0.52 non-poly cost. Average cost of polysilicon per watt was at $0.14, or $25 per kg using 5.5 grams average in the watt. Best overall wafer processing went to GCL-Poly at $0.12 per watt, also the cheapest poly production cost at $18.2 per kg.

Cost-reduction opportunities remain in polysilicon and raw materials pricing. Quality and efficiency can help with higher module ASP. Automation, while involving capital costs, may offer cost reduction in labor, particularly in module assembly. Local presence could also help, when assessing shipping costs. Slim module construction is part of the solution to mitigate this cost.

- ·PV MODULE quotation on 16.03 2018

- ·CELL quotation on 16.03 2018

- ·WAFER quotation on 16.03 2018

- ·Si Materials quotation on 16.03 2018

- ·PV MODULE quotation on 13.03 2018

- ·CELL quotation on 13.03 2018

- ·WAFER quotation on 16.03 2018

- ·Si Materials quotation on 13.03 2018

- ·PV MODULE quotation on 09.03 2018

- ·CELL quotation on 09.03 2018

· Proinso to supply solar PV products...

· SMA cuts sales forecast for 2013

· SunVault Energy Inc. to acquire int...

· NRG Energy completes first solar PV...

· Belectric USA to install 60 MW of P...

· Centrosolar Glas must declare insol...

· The Successful closing deal regardi...

· IHS-Spot Polysilicon Prices were Ex...

· Nexolon Aspires to Global Leadershi...

· South Korean Solar Duo Takes on the...

· China starting an investigation to ...

· The latest PV policy and FIT in Pol...

· CORPORATION--Zhongli Talesun Solar ...

· Centrotherm bankruptcy will not aff...