Spot Polysilicon Prices were Expected to have a Bottom Bounce in the Beginning of 2013

Author:Glenn Gu – Senior Analyst, IHS Solar

Polysilicon prices declined further inOctober with Spot poly-prices took the lead which was in line with IHS Solar’sexpectation in IHS’s September survey. Increasing proportion of secondarypolysilicon traded in the spot market dragged the average spot prices downfast.

IHS Solar expects all categories ofpoly-prices to continue declining. However, industry’s expectation onpoly-prices to be stabilized in 2013 start was gradually increasing. Accordingto IHS Solar’s observation, the mood reflects a rather prices bottom bouncinganticipation than one on actual supply-demand balance by that time.

Demand

Less polysilicon shipment was observed in Octoberby IHS Solar. The volume of both LTA and spot polysilicon shipment declined inthe month. This month’s survey by IHS Solar’s poly-prices survey showed ashipment volume of only 2,745 MT which reflects 14% less than of September.Based on the survey, IHS Solar expects September merchant shipment falls intothe range of 7,000MT ~ 8,000MT, another 20% less than that of September level.Some buyers stopped taking polysilicon in the month since their existingpoly-inventory can well meet the October demand. On the other hand, weak polysiliconspot market continued in the month as many buyers only tended to buy smallamount of secondary polysilicon on spot in an effort to bring their blendedpolysilicon cost down.

The rumor on the preliminary ruling ofChina’s polysilicon anti-dumping and countervailing investigation against USand S.Korea poly-suppliers to be announced soon in November played negativelyrole and made some buyers hesitant to execute poly-LTA from poly-suppliers ofthese regions.

Supply

October was a very tough month for most ofthe polysilicon suppliers. Poly-supply in the market was still abundant withchannel inventory being high. In Q3-12 especially in September, very highvolume of polysilicon was imported into China. However, according to IHS Solar’sprevious monthly poly-prices trackers, the merchant shipment of polysilicon atbuyers side were weaker MoM from August. In October, more Chinese tier 2 / tier3 poly-manufacturers stopped production due to sluggish market and continuouslydeclining prices. In the meantime, a few top tier manufacturers reduceproduction due to multiple reasons in the month. IHS Solar saw the supplyvolume decreasing in the month however the channel inventory was still highalthough the market showed signs of channel inventory depleting. As saidbefore, IHS Solar expected top tier poly-makers to work on moderate productionreduction and inventory clearing in the next couple of months.

CurrentPrice

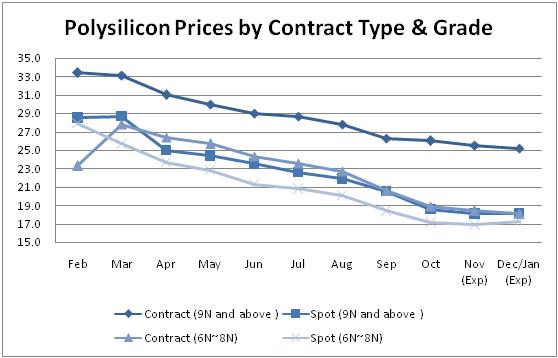

Poly-prices were declining in September. Priceof contracted 9N and above grade polysilicon is still comparatively high at USD26.0/kg while that of same grade polysilicon traded in the spot market was atUSD 18.9/kg. 6N~8N spot poly-price was at USD 17.1/kg as increasing proportionof secondary polysilicon traded in the spot market dragged spot-prices down andmake it well below the production cost of most of the suppliers.

PriceOutlook

Looking ahead, IHS Solar anticipants thatpoly-prices will continue declining in November due to existing high channelinventory. But in the meantime, a possible slight revival of spot poly-pricesin 2013-year start was expected by IHS Solar as the depleting channel inventorywill help the shipment shares of normal-grade polysilicon to increase in thespot market by then. IHS Solar recognizes that right now the spot poly-priceswere too low which made part of sellers to rather put it in the stock than tosell it. However, contract poly-prices are still expected to declining duringDecember and January due to overall supply and demand imbalance and cost downrequirement from the downstream.

Conclusion

October was one of the weakest months forpolysilicon demand since this February, according to IHS Solar’s polysiliconmonthly price tracker. Prices continued declining in the month and wereexpected to decline further in November. IHS Solar expects top tierpoly-manufacturers to react the weak market and high channel inventory withmoderate production reduction Average spot poly-prices are expected to revive slightlyin beginning of 2013 since IHS Solar expects less proportion of secondarypolysilicon to be sold in the spot market by then.

Important note: IHS Solar doesn’t includeany impact of the polysilicon anti-dumping/countervailing

Figure1: Polysilicon Price by Contract Type and Grade (Feb 12 ~ Jan 13)

Companies Mentioned

GCL

OCI

Hemlock

Wacker

REC

LDK

- ·PV MODULE quotation on 16.03 2018

- ·CELL quotation on 16.03 2018

- ·WAFER quotation on 16.03 2018

- ·Si Materials quotation on 16.03 2018

- ·PV MODULE quotation on 13.03 2018

- ·CELL quotation on 13.03 2018

- ·WAFER quotation on 16.03 2018

- ·Si Materials quotation on 13.03 2018

- ·PV MODULE quotation on 09.03 2018

- ·CELL quotation on 09.03 2018

· Proinso to supply solar PV products...

· SMA cuts sales forecast for 2013

· SunVault Energy Inc. to acquire int...

· NRG Energy completes first solar PV...

· Belectric USA to install 60 MW of P...

· Centrosolar Glas must declare insol...

· The Successful closing deal regardi...

· IHS-Spot Polysilicon Prices were Ex...

· Nexolon Aspires to Global Leadershi...

· South Korean Solar Duo Takes on the...

· China starting an investigation to ...

· The latest PV policy and FIT in Pol...

· CORPORATION--Zhongli Talesun Solar ...

· Centrotherm bankruptcy will not aff...